What is Real Yield Definition?

Real yield is the interest rate that an investor receives from the government bonds after deducted with the inflation rate. The real yield is simply calculated by the nominal yield minus the actual or expected inflation rate.

The real yield reflects the real return in the form of purchasing power that investors will receive. The concept of real yield is the same as real interest rate in the fisher effect theory by Irving Fischer.

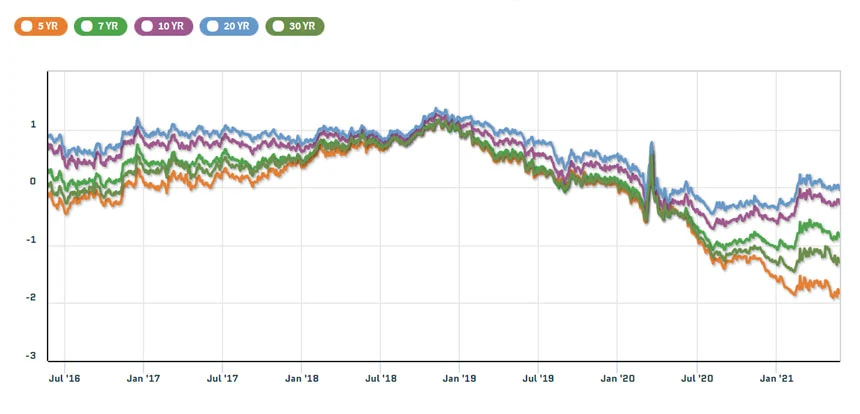

The real yield (5-year, 7-year, 10-year, 20-year, 30-year) is published by U.S. Department of the Treasury at Daily Treasury Par Real Yield Curve Rates

Key Points

- Real yield is the interest rates that an investor receives from the government bonds after adjusting with inflation rate.

- The real yield is simply calculated by the nominal yield minus the actual or expected inflation rate.

- If a bond yield is 6% and inflation is 3%, then a real yield is 3%.

- The concept of real yield is the same as real interest rate.

How to Calculate Real Yield

Real yield is the difference between nominal yield and actual or expected inflation rate. Then, the real yield equation is simply as the nominal yield minus the actual or expected inflation rate.

Real Yield = Nominal Yield – Expected Inflation Rate

where:

- Nominal yield is the nominal coupon or a treasury yield, typically 10-year U.S. Treasury yield.

- Expected inflation rate is the rate which consumers, businesses, investors expect, they’re using to making economic decisions. Inflation expectations as measured by the 10-Year Breakeven Inflation Rate.

For example, a 10-year U.S. Treasury bond yield with a nominal yield of 6% and expected inflation is 3%, then the real yield is 3%.

What Real Yield Telling Us?

To understand the real yield, first you need to understand inflation. The inflation are goods and services in an economy. Speaking of your saving account, interest is increasing the amount of your deposited, while inflation is reducing the value of your money.

Once the inflation is more than the interest, then your purchase power is reduced by the difference between the interest rate (nominal yield) and inflation rate. This is the situation called a “negative real yield”. This is a serious implication for investing, negative real yields push investors to take on risk investment because an investor would not be able to receive a rate of return over inflation.

Knowing the real yield gives you an idea of what to invest, and where to allocate your investment to ratain your purchasing power to make a profit among the inflation.

The lower number of a real yield, especially a negative real yield could lead the investor to become more reluctant to invest in safe asset like the government bonds and search for more yield. Typically, the lower real yield leads an investor to invest in gold, stock, and other higher risk assets. As you can see, from the chart above the lower real yield could lead the investor to invest in gold. In contrast, the higher real yield will lead investors to invest in risk-free investment like the government bond.

References:

- US Treasury Real Yield (5, 7, 10, 20, and 30 years) from Nasdaq

- US Treasury Real Yield vs. Gold chart from TradingView

- 10-Year Breakeven Inflation Rate (T10YIE) published by Stlouisfed

- Decoding the “real” disconnect between interest rates and inflation by Blackrock